pinellas county sales tax 2021

There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation. Dane County collects the highest property tax in Wisconsin levying an average of 18 of median home value yearly in property taxes while Iron County has.

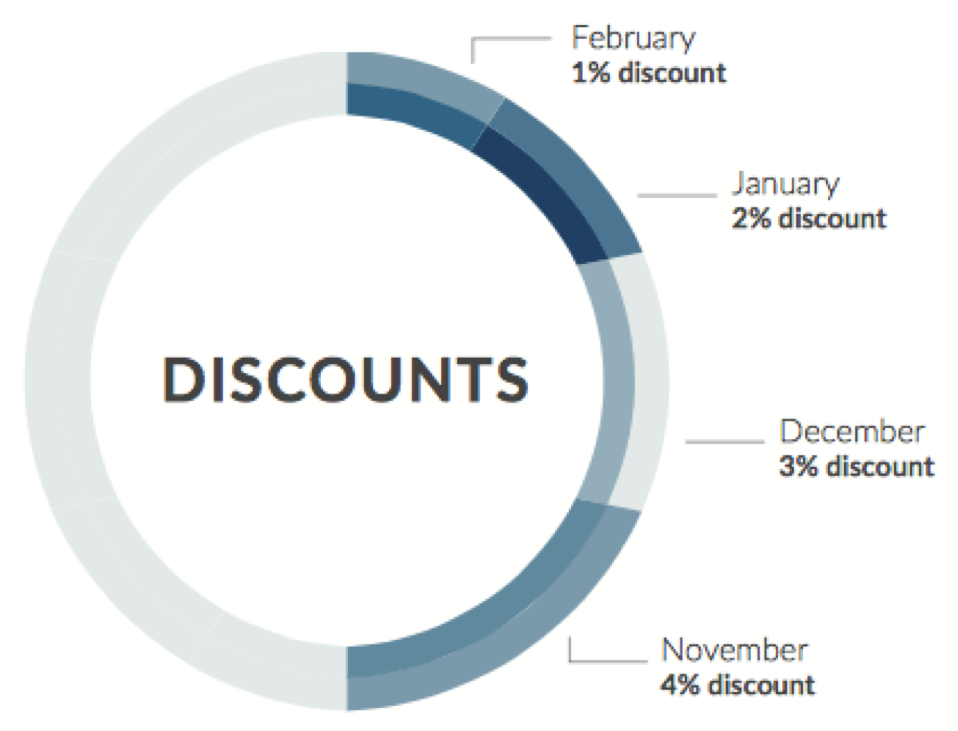

Florida Sales Tax Information Sales Tax Rates And Deadlines

The exact property tax levied depends on the county in Ohio the property is located in.

. Johnson County collects the highest property tax in Iowa levying an average of 143 of median home value yearly in property taxes while Pocahontas County has the. Ballotpedia is covering municipal elections in 81 counties and 81 cities including 34 mayoral elections in 2022We provide comprehensive coverage of elections on the ballot in Americas 100 largest cities by population each year. The court will then set a hearing date for both the landlord and the tenant to attend see Fla.

Marin County collects the highest property tax in California levying an average of 063 of median home value yearly in property taxes while Modoc. Official 2022 tax roll opens Nov 1. Mohave County collects on average 054 of a propertys assessed fair market value as property tax.

As a result a total of 679 billion of property taxes were assess in 2022 an increase of almost 200 million from the. West Virginias median income is 44940 per year so the median yearly property tax. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

The exact property tax levied depends on the county in Wisconsin the property is located in. For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020. Name Pinellas County Tax Collector Address 29399 US Highway 19 North Ste 100 Clearwater Florida 33761 Phone 727-464-7777 Hours Open Daily.

Pinellas County TRIBUTE TAX DEED SEARCH. South County 2500 34th St. Our coverage scope for local elections continues to.

Delaware County collects the highest property tax in Ohio levying an average of 148 of median home value yearly in property taxes while Monroe County has the. Work backlog reports for managing the business and processesprocedures for everyone to follow. The exact property tax levied depends on the county in Iowa the property is located in.

The median property tax in Franklin County Ohio is 2592 per year for a home worth the median value of 155300. Mid County Co-located wTax Collector 13025 Starkey Road Largo FL 33773 Get Directions. Franklin County collects on average 167 of a propertys assessed fair market value as property tax.

Wisconsin is ranked 8th of the 50 states for property taxes as a percentage of median income. Ohio is ranked 20th of the 50 states for property taxes as a percentage of median income. Click here for a larger sales tax map or here for a sales tax table.

North County 29399 US Hwy 19 N Clearwater FL 33761 Mid County 13025 Starkey Rd Largo FL 33773 Gulf to Bay 1663 Gulf to Bay Blvd Clearwater FL 33755 South County 2500 34th St N St. N 2nd Floor St. The proposal raises Hillsborough Countys sales tax from 75 to 85 and is expected to generate 342 million in its first full year of collection.

With 2021 sales of 4 million and 20 employees in place the business has a solid foundation for. Each subsequent 10000 percent. First 10000 or fraction thereof.

P ɪ ˈ n ɛ l ə s. County Courthouse 315 Court Street 2nd Floor Clearwater FL 33756 Get Directions. California is ranked 15th of the 50 states for property taxes as a percentage of median income.

For further information call 727 464-3424. The proposal which has won the backing of the Clearwater and St. Combined with the state sales tax the highest sales tax rate in Florida is 75 in the cities of.

If the tenant chooses to fight the eviction and does not move out within the specified time period then the landlord will typically file a complaint at the courthouse in the county where the rental property is located. List of cities by population. Pinellas County Tax Collector Contact Information.

Full payment must be received within 24 hours of placing the winning bid. As well as the schedule of upcoming tax deed sales for Pinellas can be found here. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

Cook County collects on average 138 of a propertys assessed fair market value as property tax. The median property tax in Mohave County Arizona is 916 per year for a home worth the median value of 170600. The exact property tax levied depends on the county in Texas the property is located in.

We also cover elections for mayors city council members and district attorneys in each state capital. Search tax deed records by sale date or a. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia.

King County collects the highest property tax in Washington levying an average of 088 of median home value yearly in property taxes while Ferry County. 20000 or 5 of the highest bid. Tax deed sales in Bay County require a 200 or 5 deposit for the winning bid.

Processing application for tax deed sale. Disbursement of excess proceeds of tax deed sale. Address Phone Number and Hours for Pinellas County Tax Collector a Treasurer Tax Collector Office at US Highway 19 North Clearwater FL.

Receiving Money into Court Registry. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15There are a total of 367 local tax jurisdictions across the state collecting an average local tax of 1036. The exact property tax levied depends on the county in California the property is located in.

King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the. Florida Tax Deed Sales. Petersburg FL 33713 Publix Locations.

The following is a list of all cities towns. 2nd installment payment for 2022 property taxes payable Sept. Washington is ranked 11th of the 50 states for property taxes as a percentage of median income.

Deposit Required from high bidder at sale. The median property tax in West Virginia is 46400 per year049 of a propertys assesed fair market value as property tax per year. Franklin County has one of the highest median property taxes in the United States and is ranked 252nd of the 3143 counties in order of median property taxes.

Petersburg City Councils would rely on a 1 sales tax and would have to go before voters for approval. The exact property tax levied depends on the county in Washington the property is located in. North County Northside Square 29269 US HWY 19 North Clearwater FL 33761 Get Directions.

We often have a variety of Pinellas County FL business opportunities for sale like coin laundries bakeries retail shops websites and more. Complete list of upcoming sales by county 2021. Tax Deed Department Fees.

If the ballot passes it will commence Jan. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. Iowa is ranked 26th of the 50 states for property taxes as a percentage of median income.

Petersburg FL 33713 Get Directions. In King County Washington property values increased 9 from 2021 to 2022. Arizona is ranked 1632nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

How To Calculate Florida Sales Tax On A Motor Vehicle Purchase

Property Taxes In Pinellas County Pinellas County Tax Collector

10 Florida Sales Tax Holidays 2022 Habitat For Humanity Of Pinellas And West Pasco Counties

Property Taxes In Pinellas County Pinellas County Tax Collector

Where To Find The Cheapest Prices On Dog And Cat Food

Buy Red Wigglers Worm Composting And Vermicomposting Supplies

Florida Solar Incentives Tax Credits Guide 2022 Palmetto

2022 Ford For Sale In North Vancouver Cam Clark Ford North Vancouver

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

How To Calculate Florida Sales Tax On A Motor Vehicle Purchase

How To Calculate Florida Sales Tax On A Motor Vehicle Purchase

Florida Vehicle Sales Tax Fees Calculator

How Do Closing Costs Get Paid In Short Sales Home Buying Process Home Buying Home Ownership

Florida Vehicle Sales Tax Fees Calculator

Buy Red Wigglers Worm Composting And Vermicomposting Supplies

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro